Section 1332 Waivers Reduce Premiums

Healthcare costs are taking the largest leap in years, with costs for employer coverage expected to surge almost 7% in 2024, according to Mercer and WTW.

Premiums are also rising 6% on average in the individual markets, according to KFF.

Almost 40% of adults skipped or put off healthcare in the past year because they couldn’t afford it, says a recent Commonwealth Fund survey. The general sentiment is that large-scale solutions are needed to move the dial on costs, especially for individuals who fall into a coverage gap where they do not qualify for Medicaid or many individual market subsidies. One effort that has garnered the attention of state insurance departments is the public option plan.

A “public option” is a government-run insurance plan offered to compete against private health insurance. In some cases, the government administers the plan and bears financial risks; in others, states contract with or require private health insurers to offer new plans on the individual insurance markets. States have various levels of control over prices and network construction.

Most public options are relatively new, but costs have not decreased to impact affordability or the rates of uninsured and underinsured.

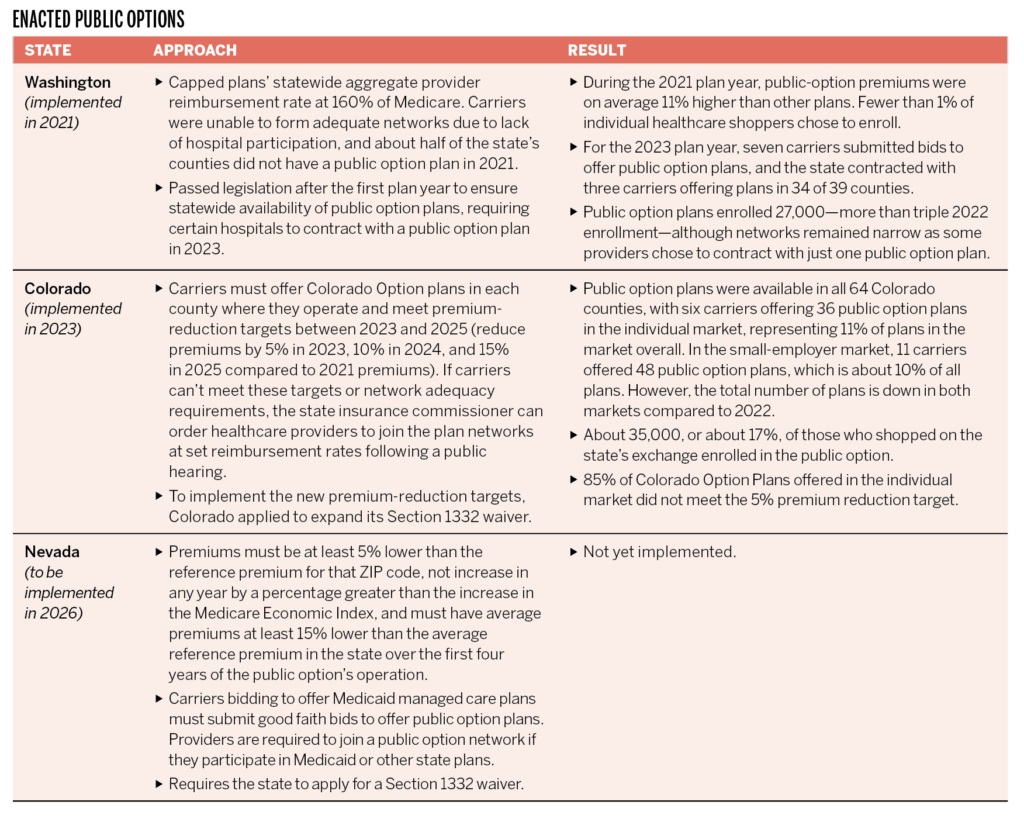

Enacted Public Options

Three states—Washington, Colorado and Nevada—have enacted laws creating public health insurance options where they partner with

private carriers (see table).

Republican Governor Joe Lombardo wants to revise Nevada’s public option to create a “market stabilization program.” Lombardo’s Democratic predecessor ushered in the public option law before leaving office in 2023. The state intends to use federal funds through the application of a Section 1332 waiver (1) to finance a reinsurance program for health insurers operating in the individual market, (2) to establish a quality incentive payment program to reward insurers offering public option plans that meet certain metrics, and (3) to fund initiatives to increase Nevada’s healthcare workforce capacity to improve access and lower the cost of care.

While Lombardo’s approach doesn’t erase the fact that a public option will be implemented in the state, his recharacterization of a public option plan suggests that he is focused on long-term measures to increase market competition and tackle the underlying cost of care. To date, established public options are not designed to address healthcare cost drivers or to lower provider prices. Nevada is also the only state to fund a reinsurance program with only federal funding; most others use a combination of state and federal funds. The basis of this idea is to build the program around the funding received and then invest the rest into the forthcoming quality incentive program.

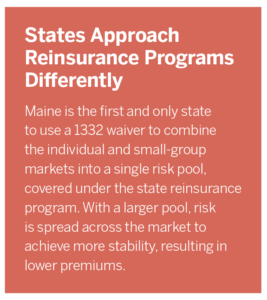

Section 1332 of the Affordable Care Act (ACA) permits a state to apply for a State Innovation Waiver to pursue strategies that provide residents with access to high-quality, affordable health insurance. There are 17 states that have applied for and received Section 1332 waiver funding to construct a reinsurance program. The waivers gained traction after a federal reinsurance program established by the ACA ended in 2016 and carriers started leaving the individual market.

These solutions grant federal pass-through funding to provide additional cover for insurance companies operating in the individual market. Through reinsurance, the federal government reimburses insurers for a percentage of claims that exceed a certain threshold. Offsetting high-cost claims mitigates insurer risk and allows insurers to price plans more competitively.

Two other states have turned to these waivers to subsidize state public option plans. In Colorado the federal waiver allows the state to operate its reinsurance program alongside its public option to help subsidize premiums and cost sharing for individuals who aren’t eligible for federal subsidies or federal premium tax credits. The Department of Health and Human Services (HHS) calculated that the public option plus the reinsurance program would reduce monthly premiums in Colorado by 22% in 2024, compared to the 20% reduction that would be achieved by reinsurance alone.

In Washington state, waiver funding will allow all uninsured Washingtonians to receive health and dental coverage on the state’s health insurance marketplace. It will also be used to subsidize coverage for those with incomes up to 250% of the federal poverty level as well as immigrants lacking federal documentation. The insurance industry was notably supportive of this waiver because of its ability to stabilize the individual insurance market.

The use of Section 1332 waivers to subsidize public option plans is significant in that other states will likely follow suit. The waiver has previously been used to establish public/private partnerships between carriers and state governments through a federally funded reinsurance backstop. Expanding that backstop reduces risks for insurers that are required to offer public option plans with lower premiums and subsidizes the individuals enrolling in those plans.

The federal government is also currently subsidizing individual market enrollments through the American Rescue Plan, which reduces the amount of income individuals and families are expected to contribute toward premiums for individual market coverage and extends premium tax credits to households with income up to 400% of the federal poverty level. The overall level of government involvement in the individual insurance markets raises questions about what long-term market stability might look like. Will there be an opportunity to reduce government involvement if market competition increases? How will affordability of different types of health coverage be impacted?

Pending Efforts

California > California has been pursuing some form of a single-payer program for decades. As recently as 2022, The California Guaranteed Health Care for All Act (CalCare) was introduced. It would have provided single-payer coverage funded through a taxation plan, including an excise tax on certain businesses and a payroll tax for employers with more than 50 employees.

In October 2023, California passed a law to research and pursue (Section 1332) waiver discussions with the federal government to establish a unified healthcare financing system. An interim report with preliminary analysis and stakeholder input is due by Jan. 1, 2025. The insurance industry and other stakeholders opposed the legislation throughout the session. Of note, the California Nurses Association, which has been the lead supporter of single-payer legislation, also opposed the bill, arguing that it could derail its own single-payer legislation. Any kind of government-run healthcare is expected to have a major fiscal impact on the state budget, so funding that type of move will prove to be challenging.

Minnesota > In May 2023, the state passed a law requiring the commissioner of human services to work with an actuarial firm to perform actuarial and economic analyses of different public option models, develop a final recommendation on implementing a public option plan by Jan. 1, 2027, and develop waiver processes.

Washington > Washington has been particularly active in pursuit of government-run healthcare. Not only was it the first state to establish a state-run public option plan, but it’s also now working to establish universal healthcare. The state introduced a single-payer bill, which was referred to committee in January 2023, but no additional action was taken during the most recent legislative session. Washington’s next session meets in January 2024, so the bill would need to be reintroduced at that point.

What’s Next

Federal single-payer discussions appear to have tapered off or at least given way to other practical reforms like prescription drug costs and other industry transparency measures aimed at giving stakeholders more information about the health plans they’re purchasing for themselves and on behalf of their employees.

It does seem likely, however, that other states will follow suit in evaluating whether government-run public option plans are an effective lever to increase market competition and manage costs. Some states may even explore alternative ways to transfer risk from insurers, including shifting the financial risk of providing care to hospitals and other providers by requiring them to have skin in the game.