Easy Street

Insureds today enjoy the softest directors and officers (D&O) market since 2017, but all this sunshine conceals the first clouds of a gathering storm.

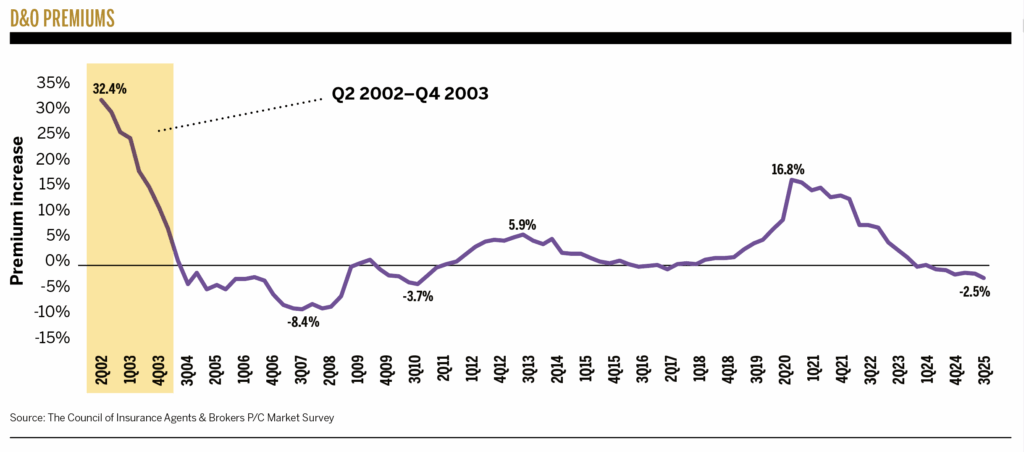

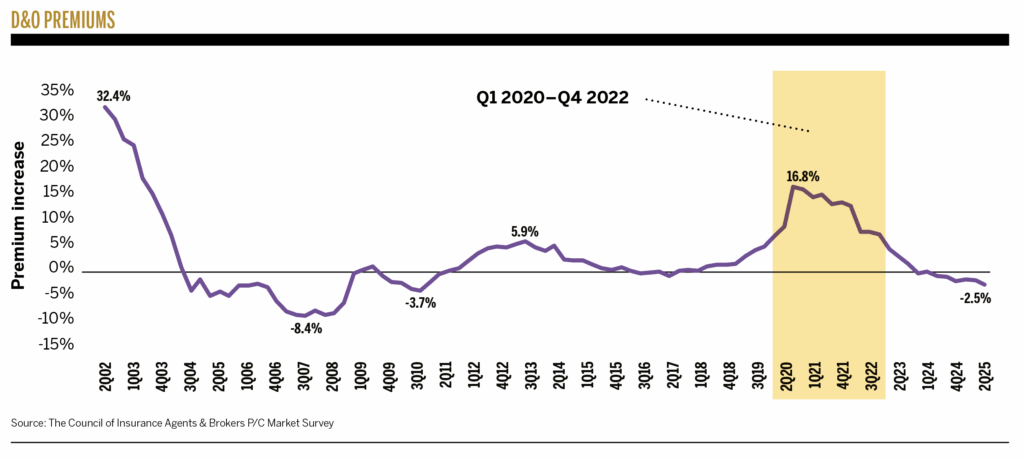

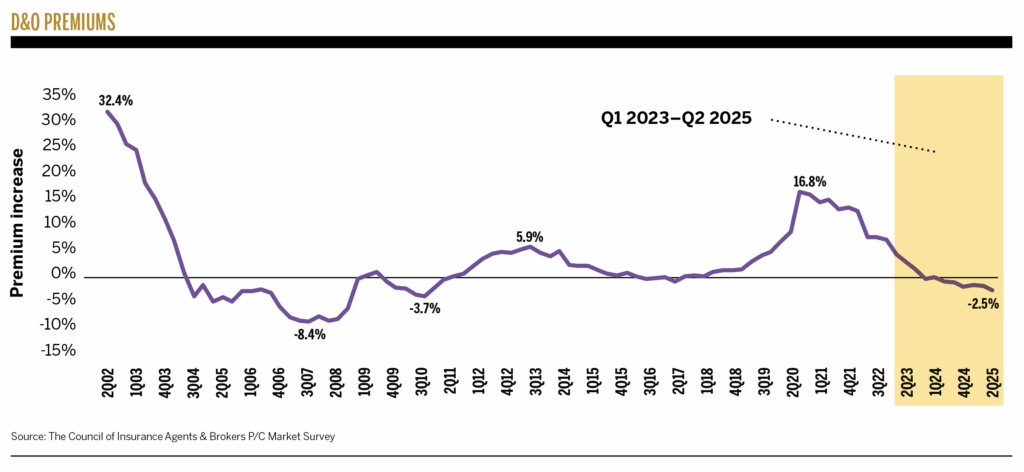

Today, over $1 billion in surplus D&O capacity is sloshing around, Aon notes in its Management Liability Insurance Market in 2025 report. The cost of coverage has dropped sharply since mid-2022, according to most any industry source. For example, The Council’s Property/Casualty Market Survey shows average premium increases for the D&O line slowing rapidly starting in 2022, with premiums beginning to decrease in mid-2023. Respondents have even said that some carriers were decreasing D&O premiums to compensate for increases in other lines of business, such as umbrella.

Soft D&O market conditions in 2025 are a boon to insureds. Price and the overall cost for coverage are down, and many companies can renew their policies at the same limits and deductibles without an increase in premiums—or, in some cases, with a decrease in premiums.

Current market conditions result from a hardened market from 2020 to 2022, caused by a spike in class action litigation. High prices for coverage attracted many new market entrants, which, combined with a sudden drop in demand for D&O coverage in 2022, led to intense carrier competition and today’s softened market.

Industry observers like AM Best, brokers, and carriers have all expressed concern that the soft market will leave the industry unprepared for future claims given the current risk environment. AI washing and DEI backlash are two emerging sources of claim risk, and nuclear verdicts driven by social inflation are exerting upward pressure on settlements and awards.

For companies that had recently gone public, the median decrease in renewal cost for D&O coverage exceeded 25% every quarter between Q2 2022 and Q2 2024, brokerage Woodruff Sawyer’s D&O Looking Ahead guide for 2025 shows. The median decrease in renewal cost for D&O coverage for mature public companies ranged from 4% in Q2 2022 to 20% in Q1 and Q2 2023, according to the guide.

Aon’s report finds similar trends for public and private companies. Pricing for private D&O coverage fell every month of 2024, with decreases ranging from 2% to 9.3%, while public D&O pricing monthly decreases ranged from 4.8% to 13.0%.

These favorable market conditions have benefited insureds in other ways. In its Q2 2025 D&O Pricing Index, Aon said that insureds comfortably maintained the same limits and deductibles on renewals in 2025 without the usual cost increase. Indeed, prices decreased for 40% of accounts that renewed with the same limit and deductible. The Woodruff Sawyer guide suggests that public company insureds can likely take advantage of current market conditions to raise limits and adjust their D&O program structure.

Industry sources, however, including experts interviewed for this article, suggest that the current length of the soft market will leave the D&O market unprepared for emerging risks. “Prospective D&O underwriting results could indicate that market premiums have fallen too far, too quickly,” ratings agency AM Best warned in a March 2025 commentary.

If the situation continues, the market is likely to face sharp and sudden corrective pricing action similar to the hard market of 2020 to 2022 or even the infamous hard market from 2001 to 2003, straining insureds’ balance sheets and risking some going bare in a time where new litigation risks are taking shape, warn both Priya Cherian Huskins, senior vice president for management liability at Woodruff Sawyer, and David Guild, head of financial lines at insurer MSIG USA.

As Patrick Baker, private D&O project manager at insurer Travelers says, “Because private company D&O policies can be triggered by claims brought by a wide group of claimants making a variety of allegations, the risk landscape is vast and constantly evolving. Whether a company is facing technological challenges, regulatory changes, or an overall sense of economic uncertainty, how it protects its directors and officers has been and continues to be critically important.”

Insureds, both public and private, may also face tightened underwriting and reduced capacity, much as they did in the most recent hard market. Altogether, while insureds today are favored by the market, that can change quickly—maybe quite soon.

To provide context on where the market might be headed, it’s helpful to study where it has been.

2001–2003: IPO Laddering, Dot-Com Bust, and Revenue Recognition

The hardest D&O liability hard market of this century, from 2001 to 2003, was driven by securities class-action lawsuits, according to both an AM Best D&O market segment report from May 2025 and a leading D&O market survey from the time by Willis Towers Watson precursor Tillinghast Towers-Perrin. A total of 498 federal securities class actions were filed in 2001, a 131% increase from 2000, data from the Stanford Law School Securities Class Actions Clearinghouse shows. Filings dropped to 265 in 2002 and further the year after, but the damage was done.

D&O premiums shot up by an average of 29% in 2001, according to the 2001 Directors and Officers Liability Survey from Tillinghast Towers-Perrin. The Council’s P/C Market Survey from the time showed D&O premium increases peaking at an average of 32.4% in Q2 2002. Aon D&O pricing numbers, indexed to a baseline of one in 2001, demonstrate prices spiking by 148% between 2001 and 2003.

Towers-Perrin shared AM Best’s assessment that the cost of shareholder litigation was the primary driver behind rising D&O premiums. The average shareholder indemnity paid in 2001 was $17.5 million (or almost $32 million in 2025 dollars), an all-time high; the average cost of D&O claims in 2001 was 75% higher than in 2000.

A 2001 study by consulting and financial services firm PricewaterhouseCoopers (PwC) found that approximately three-fourths of these securities class actions involved accusations of “IPO laddering,” in which select investors are privately offered discounted shares before an IPO in exchange for agreeing to purchase additional shares once the company goes public. That has been illegal since the U.S. Securities and Exchange Commission adopted Regulation M in 1996 to deter market manipulation.

In non-laddering lawsuits, issues related to the burst of the dot-com bubble and financial disclosure featured prominently: more than half of the lawsuits were filed against high-technology companies and 57% involved accounting allegations, primarily of improper revenue recognition, according to the PwC study.

2020–2022: M&A Merger Litigation and Cyan

That pattern recurred nearly two decades later. The number of federal securities class actions filings soared to 411 in 2017 from 271 in 2016, a 52% increase. Unlike after 2001, filings remained above 400 for the next two years, through 2019.

Analysis by the Stanford Clearinghouse in those years suggests a major reason for this jump was the movement of lawsuits objecting to corporate mergers from state courts to federal court. Forty-eight percent (198) of the 411 federal class actions in 2017, 45% (182) of 2018’s 402 class actions, and 40% (160) of 2019’s 402 class actions all involved M&A objections. For comparison, M&A objections comprised 29% of federal class actions in 2016 and just 16% in 2015.

This swarm of federal cases was primarily due to rejection by a Delaware state court of a planned settlement in In re Trulia, Inc. Stockholder Litigation, a case in which four Trulia shareholders sued the company’s directors to halt the acquisition by competing online real estate marketplace Zillow over claims that the price was too low. Multinational law firm WilmerHale characterized the situation preceding the decision in a post-Trulia litigation landscape analysis: “It used to be that boards of public companies being acquired would routinely face one or (likely) more lawsuits alleging the directors breached their fiduciary duties because they had agreed to sell too cheaply or engaged in a flawed sales process. These lawsuits were often resolved through relatively straightforward settlements, in which the company agreed to make supplemental disclosures in exchange for dismissal of the lawsuit, a release of all potential claims, and payment of a fee to plaintiffs’ counsel. [T]he Delaware Court of Chancery would routinely approve such settlements.”

In 2015, however, the Court of Chancery rejected a handful of these settlements, and the number of merger lawsuits brought in Delaware court began to fall swiftly. Given the large numbers of major businesses incorporated in the state, that’s significant. Only “34% of sales of Delaware companies for more than $100 million from October through December 2015 faced lawsuits,” WilmerHale stated, “down from 78% for the first nine months of 2015, and 95% for 2014.” The final nail in the coffin came with the ruling that rejected the Trulia settlement and created the “plainly material” standard for disclosure-only settlements, meaning approval would be based on release of key information that was “plainly material” for shareholders, law firm Sheppard Mullin explains. The resulting sprint to federal court can be seen in the Stanford Clearinghouse numbers.

Compounding this was the U.S. Supreme Court’s ruling on Cyan, Inc. v. Beaver County Employees Retirement Fund in March 2018, which allowed plaintiffs to file parallel federal and state securities suits under the Securities Act of 1933. The plaintiff’s bar jumped at the opportunity: Stanford Clearinghouse data shows a 59% increase in parallel federal-state filings under the Act between 2018 and 2019.

Cyan also led to more lawsuits against the same defendant in multiple state jurisdictions (for example, one company in 2019 faced concurrent parallel lawsuits in New York federal court, Michigan state and federal court, and Tennessee state and federal court). There were four multiple-state filings under the Securities Act of 1933 between 2010 and 2018, but seven just between the Cyan decision and the end of 2019. A company forced to defend its directors and officers in multiple jurisdictions, federal and state, can quickly multiply D&O claims costs.

Naturally, the high number of lawsuits from 2017 to 2019 and the securities settlements coming due from past lawsuits (averaging $36 million between 2017 and 2019, per the Stanford Clearinghouse) led to aggressive corrective pricing action from insurers. After nonexistent to anemic premium growth between 2014 and 2019, this action was sorely needed to build a premium base that could absorb incoming claims.

Prices for D&O coverage rose by more than 20% for nine out of 12 months in 2020, and by over 10% monthly between January 2020 and July 2021, according to Aon’s quarterly D&O pricing index. In 2018, prices were at 70% of the 2001 baseline, then rose to more than one-and-a-half times the baseline in 2020 and double the baseline in 2021.

Responses to The Council’s P/C Market Survey from that period show carriers cutting back policy limits, requiring brokers to build D&O programs by layering multiple policies from multiple carriers. Carriers were also far stricter about risks, often seeking much more information from insureds before agreeing to underwrite.

2023–2025: Competition, Competition, Competition

That hard market led directly into today’s buyer’s market. High prices create more carrier profit, which drew new entrants into the market through 2024.

The number of carriers offering primary D&O coverage increased from 45 in 2019 to 58 at the end of 2024, a 29% jump, AM Best said in its May 2025 market segment report.

At the same time, demand for D&O coverage declined in tandem with the reduction in initial public offerings (IPOs). Businesses will purchase coverage as they plan an IPO, which can expose directors and officers to litigation and regulatory enforcement for multiple reasons, including mistakes in disclosures, possible violations of securities laws, and shareholder allegations of mismanagement.

There were 1,080 IPOs in the United States in 2021, according to the SEC. That plummeted to 205 in 2022 and then to 170 in 2023—a more than 80% decrease in just two years. IPOs have remained at that level since.

Together, these developments could only lead to one thing: competition. Prices quickly fell. The Aon-indexed D&O pricing numbers dropped from 1.98 in 2021 to 1.15 in 2023 and then to 1.06 in 2025, meaning the pricing for D&O is now roughly comparable to what it was before the 2001 hard market.

As prices fell, so did premiums. AM Best figures show that total D&O direct premium written peaked in 2021 at $14.9 billion, then decreased 11% to approximately $13.6 billion in 2022, by another 15% to $11.5 billion in 2023, and 6% more to $10.8 billion in 2024.

Favorable loss outcomes have also made it difficult for carriers to increase prices. As AM Best Senior Research Analyst Christopher Graham wrote in the May 2025 report: “The [D&O] loss ratio for the fourth quarter of 2024 was the lowest quarterly loss ratio of the past seven years by a wide margin, seven points better than for any other quarter.” The total loss ratio for 2024 was 49%, the report says, down from 62.4% in 2017 and 2018 and 60% in 2019, immediately preceding the 2020–2022 hard market.

As good as all this sounds, insurance experts say the industry cannot rest on its laurels. In the same report highlighting the 49% loss ratio, AM Best also cast premium decreases as “inconsistent with the risk environment.”

Securities class action settlements, which hit D&O coverage, continue coming in, even as insurers have pulled back D&O pricing and premiums. According to Cornerstone Research, total settlement amounts nearly doubled from $2.1 billion in 2021 to $4.1 billion in 2022 and have stayed at that level through 2024.

Class action filings have also not stopped. “It’s important to note that litigation rates are in fact not down,” warns Woodruff Sawyer’s Huskins. “This means the seeds of the next harder market are being planted now.”

After briefly dipping to a seven-year low of 197 in 2022, securities class action filings have crept back up: 213 in 2023 and 222 in 2024, and Stanford Clearinghouse numbers suggest filings for 2025 will be equal to 2024’s, if not higher.

Guild notes that not only has litigation not stopped, the tail of litigation claims has also grown longer, increasing claims costs. “There’s more information to sift through: e-discovery allows for so much information to find. Consider how many emails you send per day multiplied by thousands of employees,” he explains.

More parties tend to be involved with cases these days, Guild adds. With more companies and lawyers in the mix, defense fees rise, as does the number of people who must agree to a settlement, extending case resolution time.

The size of the filings is also rising. Cornerstone Research analysis shows the approximate semiannual aggregate size of all federal and state filings has increased since 2018, most recently to $403 billion in the first half of 2025. This was a 56% increase from $259 billion in the second half of 2024, itself a 36% increase from the first half of 2024 and far above the 1997–2024 semiannual average of $125 billion. (Cornerstone Research calculates this number by estimating the impact from all information revealed during the class period by comparing the dollar value of the defendant’s market capitalization immediately prior to the end of the class period and immediately after. It should not be taken as an estimate of future actual damages, which can vary widely.)

Artificial Intelligence, Artificial Innovation

One new source of litigation stems from generative artificial intelligence (AI), also known as large language models (LLMs). Gaining mainstream recognition in 2022 with the advent of ChatGPT, the tool has been rapidly and widely adopted by businesses everywhere, including in the insurance industry. A 2024 McKinsey survey of 1,491 companies worldwide showed that 72% of respondents used artificial intelligence in at least one form; Microsoft claims that 85% of Fortune 500 companies use its generative AI solutions (but does not elaborate on what “use” means).

AI companies are also commanding huge valuations, from hundreds of millions to tens or even hundreds of billions. Forbes estimated in August 2025 that 498 AI startups are valued at over $1 billion, worth in aggregate almost $2.7 trillion. Behemoth Big Tech companies including Google, Microsoft, Meta, and Apple have all rushed to tap into the apparently inexhaustible fountain of money flowing from Silicon Valley investors.

A potent combination of money and hype means many companies are looking to apply generative AI in one way or another—or at least want to appear to be capitalizing on this fashionable trend to boost share prices and cast themselves as more attractive for investors. As Guild puts it, “What’s old is new again. When I started it was dot-com. Everybody changed their name to abc.com and got a nice little valuation bump because they were using the Internet as part of their platform. It’s analogous to AI.”

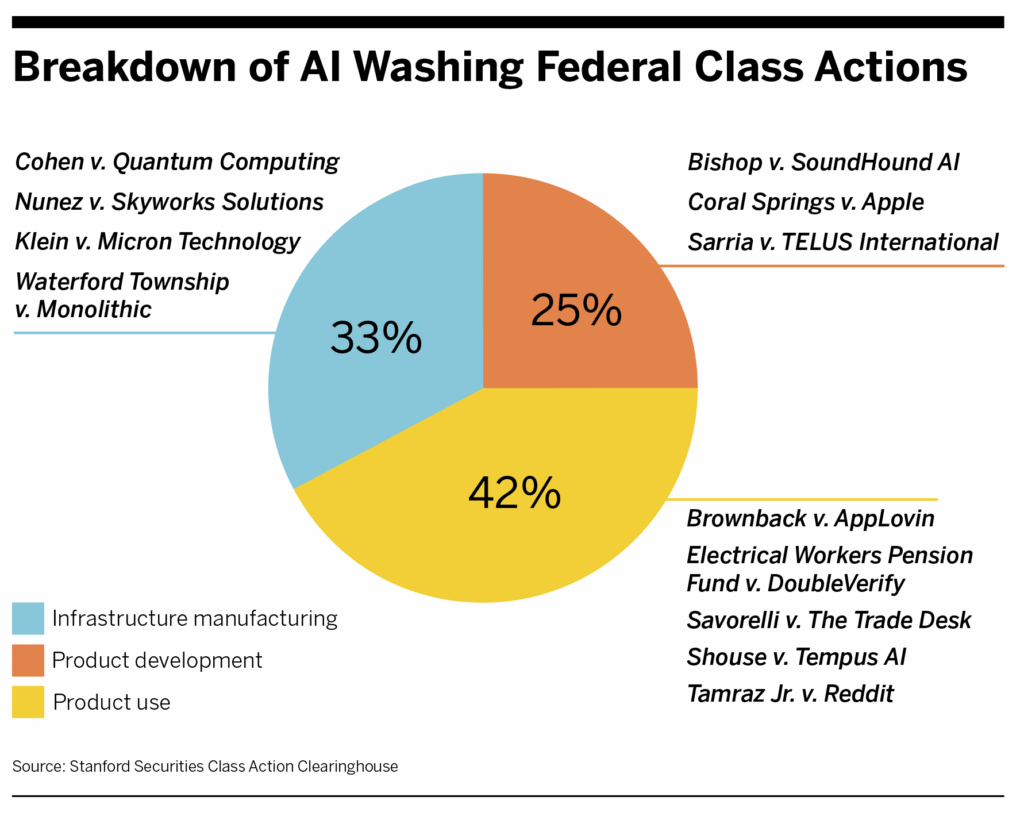

This nascent but growing phenomenon, also known as “AI washing,” has already resulted in securities class action suits against company officers: 12 had been filed in 2025 through June, almost 10% of the total class actions filed through the same period (129), compared to 15 in all of 2024 and seven in all of 2023, according to the Stanford Clearinghouse. “AI washing is certainly a real concern,” Huskins says. Since securities lawsuits involve company officers, this inevitably produces a claim against the D&O policy in force.

Stanford Clearinghouse sorts these AI washing lawsuits into three categories: whether the defendant is developing an AI product, using an AI product, or manufacturing products for underlying AI infrastructure.

- Product development suits: Allegations in these cases revolve around misleading shareholders or investors about product development timelines and costs, along with product capabilities, in order to position the company as an innovator ahead of the AI curve.

- Product use suits: Allegations in this kind of litigation center on misleading or false statements that exaggerate the effectiveness or success of an AI system rolled out by the company, or that attribute success to the technology when AI was not involved.

- Infrastructure manufacturing suits: Allegations in this category involve claims made by companies producing components (such as chips or semiconductors) for artificial intelligence infrastructure that increased demand for generative AI products will generate growth and/or additional investment in the company. When growth or investment does not manifest, litigation follows.

(For more on how these cases develop, see sidebar: A Selection of AI Washing Lawsuits.)

The U.S. government has also pursued companies for overstating or making false statements about their use of AI. In 2024, the SEC charged two investment advisors with “making false and misleading statements about their purported use of artificial intelligence,” according to an agency press release. The companies settled without admitting or denying the charges and paid a combined $400,000 in civil penalties.

Regulatory action against AI washing seems for the moment to have continued under the Trump administration. On April 9, 2025, the SEC charged the CEO of mobile shopping startup Nate with “fraudulently soliciting investments in Nate and raising over $42 million through the sale of Nate stock by making false and misleading statements about the company’s use of artificial intelligence,” per an agency press release.

Since standard D&O policies cover company legal costs for SEC activities, this represents another area of concern for claims associated with AI washing. As Walker Newell, senior vice president of management liability at Woodruff Sawyer, discusses in two articles on the financial impact of SEC actions, the procedural complexities of an investigation alone can easily run costs for the company and its D&O policy into the seven or eight figures—and that’s not even considering if the regulator takes the action to court, which can push costs magnitudes higher.

As seen in the two 21st century hard markets, increased frequency and severity of claims directly drive pricing and can substantially impact D&O underwriting in general. Facing higher prices and slashed capacity, insureds may struggle to purchase the coverage and limits they need for company officers.

As AM Best stated in its May 2025 report: “The varied ways in which companies use AI, whether its use is having the intended consequences, and how the use of AI is affecting employment and strategic decisions will be key factors for insurers to evaluate. Executives need to fully understand the risks involved in using AI and how the company discloses its use.”

Too Woke Or Not Woke Enough

AM Best and brokers like Woodruff Sawyer and Aon have also pointed to both the growing embrace of and backlash to diversity, equity, and inclusion (DEI) programs as a source of both litigation and regulatory action.

Shareholder derivative suits, rather than securities class actions, are the main problem for companies and their D&O policies when it comes to DEI. These suits are brought against company directors and officers—thus triggering a D&O claim—and often feature accusations of mismanagement, dereliction of fiduciary duties, or financial malfeasance, as derivative suits are intended to be tools for shareholders to enforce the company’s interests. Companies have found themselves the target of a shareholder derivative suit for implementing a DEI program or for not committing to a DEI program.

Perhaps most famously, a shareholder derivative suit filed in August 2023 alleged that national retail chain Target had not properly disclosed the financial risk from a backlash to its Pride Month campaign in June 2023. The suit against Target survived a motion to dismiss in December 2024 and is ongoing. In February 2025, Target was sued again over its June 2023 Pride Month campaign by the state of Florida and America First Legal, an activist law group that was also behind the August 2023 suit.

Conversely, Huskins highlights three cases brought against Cisco, Oracle, and The Gap in which company directors were accused of failing in their fiduciary duty to the company by not fostering meaningful diversity on their boards—in Cisco’s case in particular, by allegedly not following through with previous diversity commitments. All these cases were dismissed, but even reaching the dismissal stage can draw a D&O claim due to the legal costs required to get there.

Stepped-up government action against DEI programs during the second Trump administration “may lay the groundwork for more shareholder claims alleging that DEI programs created undisclosed litigation, reputational, and financial risks,” international law firm Winston & Strawn stated in an April 2025 memo. It cited a January 2025 letter from Republican state attorneys general suggesting legal action if Costco did not revoke its DEI programs, just days after the big-box retailer and 98% of its shareholders recommitted to those efforts. The administration’s anti-DEI position, including four executive orders, could also lead judges to grant more credibility to lawsuits against those programs, experts say.

As with AI, this trend signals possible increased frequency and severity of D&O claims, which if they continue to develop adversely, will trigger carrier reaction in the form of raised prices and pulling back on capacity.

Si Vis Pacem, Para Bellum

To prepare for these emerging risks, industry experts primarily recommend price increases to build a more robust premium base. “We are concerned about underpricing given the ever-upwards trends we are seeing when it comes to the legal costs and the cost of settlement,” Woodruff Sawyer’s Huskins says. MSIG USA’s Guild was more blunt: “Rates will go up simply because they have to.”

But the industry can also pursue other avenues that won’t put as much stress on insureds.

When it comes to AI, both brokers and carriers offer similar advice. Huskins emphasizes that companies should review their disclosures to avoid language that may draw a lawsuit; Guild, too, suggests companies should take a hard look at how they are using AI.

“AI washing is absolutely something that we look at and we challenge companies on,” Guild says. “How is AI being integrated into your business operationally, competitively? What about it is of value to you? What kind of AI is it? And then you get into the specifics of underwriting: there are a lot of folks who are investing in AI. But is that worth a valuation increase in the company? I don’t think it’s for us to judge. It’s for us to evaluate for the risk assessment.”

Huskins thinks insureds should apply similar thinking to minimize risk from their DEI programs. Assess what initiatives and commitments the company has in place; determine if they are delivering measurable value; and ensure DEI programs are aligned with short- and long-term strategic business goals. If the DEI initiatives fail those last two tests, consider modifying or eliminating them outright.

Both Guild and Huskins also point to a possible concern for the industry: third-party litigation funding. Right now, they say, plaintiff firms in the United States are already so well-funded it has yet to become a systemic issue for financial lines like D&O—“the big plaintiff firms aren’t in any way starved for capital,” Huskins says. But it could become an issue in the future by fueling higher numbers of D&O lawsuits.

Huskins highlights a more immediate litigation risk the industry should focus on mitigating: the “enormous fees” being awarded by courts. Nuclear verdicts have been a pressing industry theme since the early 2020s, but Huskins highlights recent outcomes of lawsuits brought in the Delaware Court of Chancery as a particular concern.

After In re Dell Technologies Inc. Class V Stockholders Litigation was settled in 2022, plaintiff attorneys were awarded fees equal to 26.67% of the $1 billion settlement, or $266.6 million. That was the second-highest amount of attorney fees awarded in the history of the Delaware court, behind the $304 million awarded in Americas Mining Corp. v. Theriault Southern Copper Corp. in 2012. At least it was until December 2024, when the Delaware Chancery Court granted $345 million in fees to plaintiff attorneys involved in the shareholder suit against Elon Musk attempting to revoke his 2018 compensation package at Tesla.

“These outsize fees set up lottery-like incentives for plaintiffs to swing for the fences,” Huskins says. And when they hit a home run, D&O policies pay.

To best help their clients, according to Huskins, brokers should “Stay current on trends and be in conversation with outside counsel, both corporate and litigation side.” Brokers are also a “key cog” in mitigating D&O risk and in the insurance industry more broadly, says Travelers’ Baker, as they can “bring together clients they know well with carriers whose products and services best meet a company’s needs.”

For Guild, brokers’ wealth of data is critical for helping both their clients and the insurers they partner with prepare for these new D&O risks. Investing in being able to share that data allows brokers to provide crucial perspective to insureds. “It’s a partnership of us adding our two cents and then being willing to listen to other perspectives as well,” he says. “We’re not trying to scare you into buying insurance from us. It’s our job to get past just being capital and to provide experience and perspective.”